Technology innovation makes it possible for the wealth management industry to meet an ever-changing array of challenges and opportunities. That’s why First Rate developed machine learning solutions that facilitate and enhance data processing and analysis, enabling you the manager to create unique and effective investment strategies. We understand your market is unique, it’s why at First Rate we take a market-centric approach to wealth management that includes a comprehensive suite of wealthtech solutions precisely tailored to firms with $5-10B AUM. You now have access to unsurpassed customization and scalability with intuitive tools that require limited training, allowing you to focus more on client relationships.

This suite of products will drastically simplify your tech stack, providing intuitive tools that can be scaled and customized. Solutions like our Data Aggregation as a Service AI engine turns complex data into clear insights, and our recently updated Core 2.0 allows you to build customized reports with lightning speed.

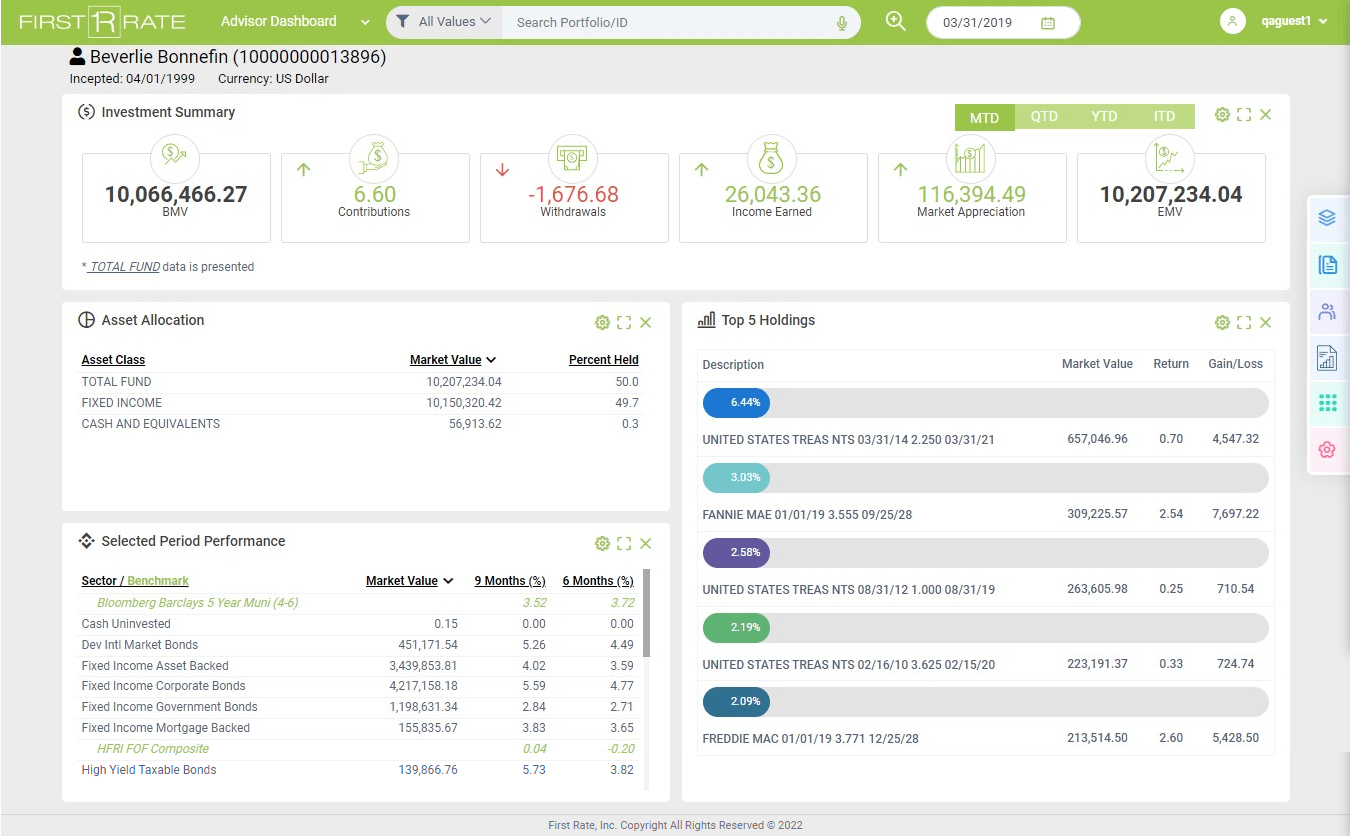

CORE 2.0™ Comes loaded with a suite of innovative tools, featuring an advisor dashboard and a report builder that adds ample functionality and an extensible widget library.

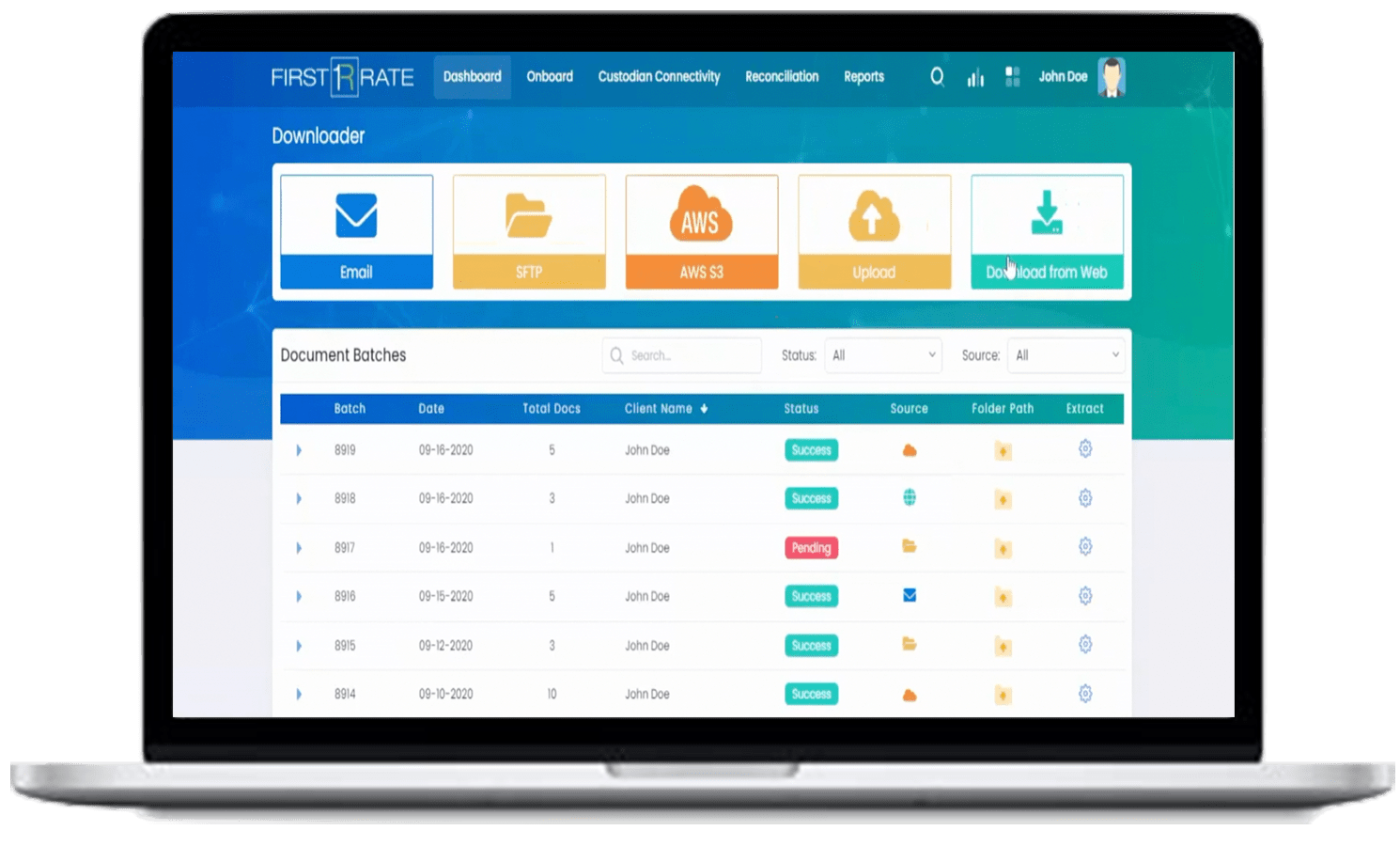

DAAS is powered by an artificial intelligence engine called ArtIE to help ingest, automate, and efficiently process structured and unstructured data sources.

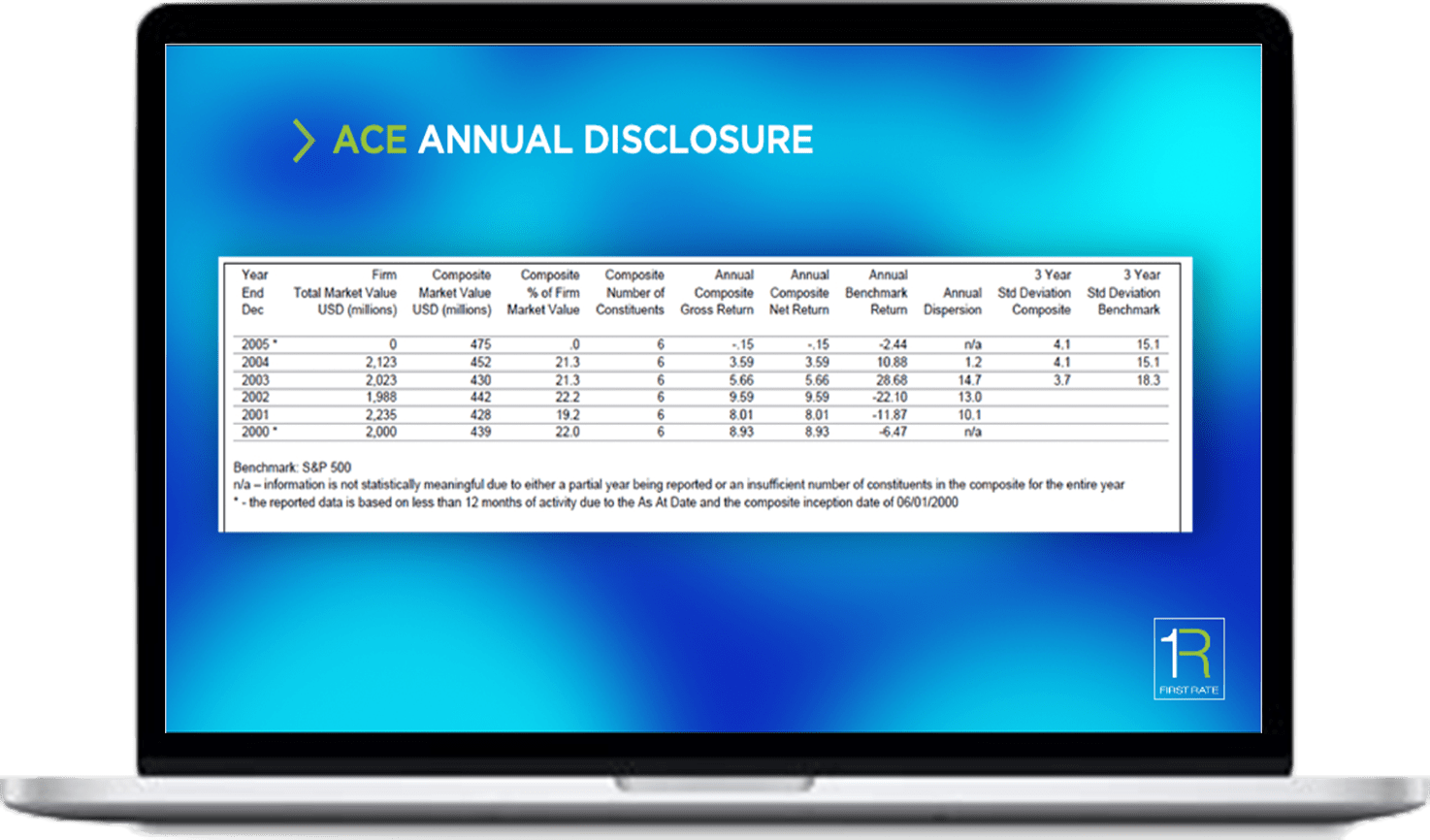

ACE is an integrated composite management solution that minimizes potential for error by improving accuracy of composite composition and investment performance results.

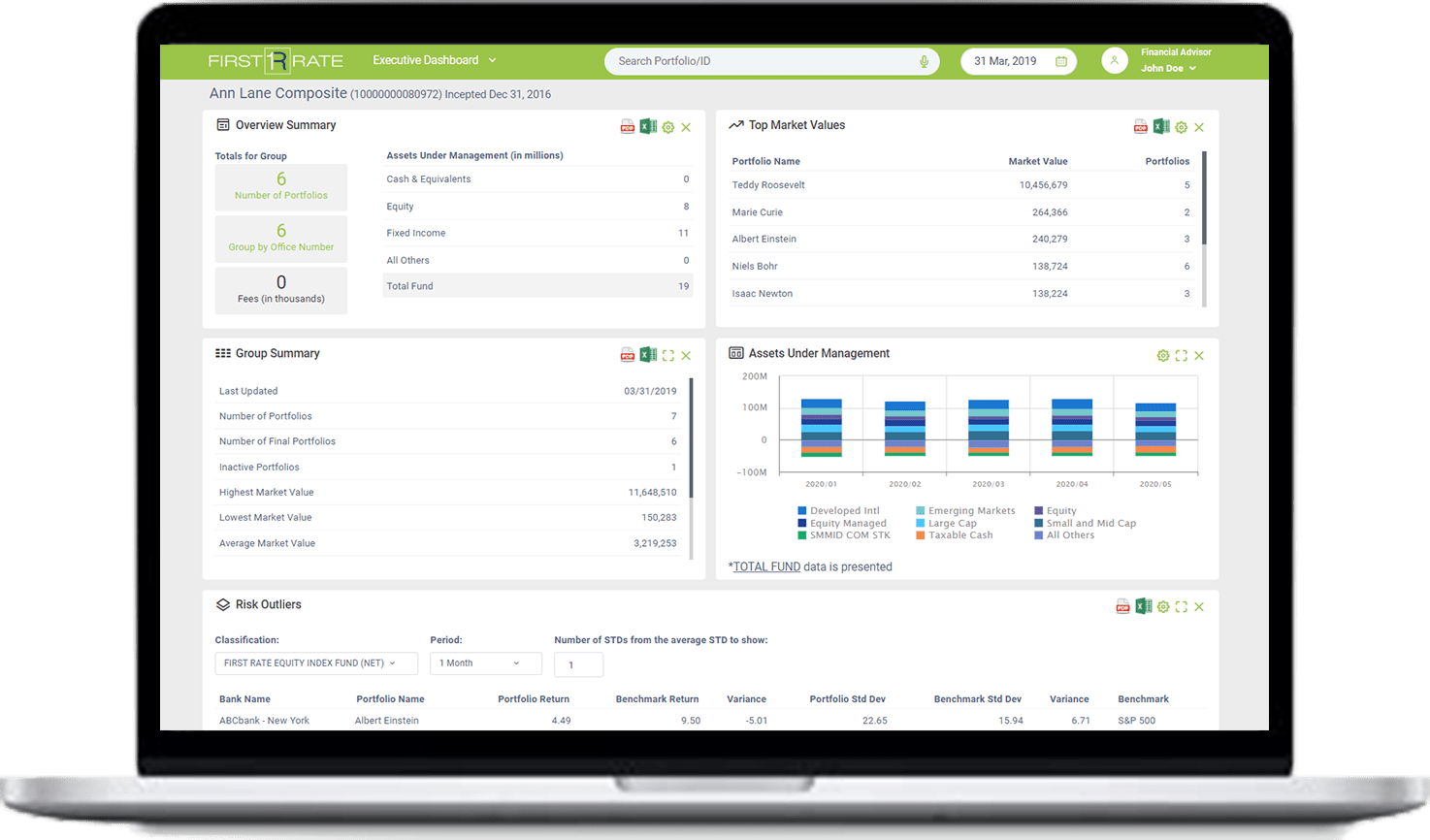

ExecView is an automated oversight and surveillance solution that allows you to analyze advisor performance and risk exposures, assess trends and identify outliers and exceptions, as well as meet your firm's surveillance needs.

Average length of relationship

accounts processed monthly

AUM

When you partner with us, you’ll have access to a team of performance experts dedicated to the $5 - $10 billion AUM market. We’ll help you tailor solutions to your firm’s specific strategy and needs, then ensure your wealth managers understand how to get the most out of your data and reporting.