Administrative Solutions

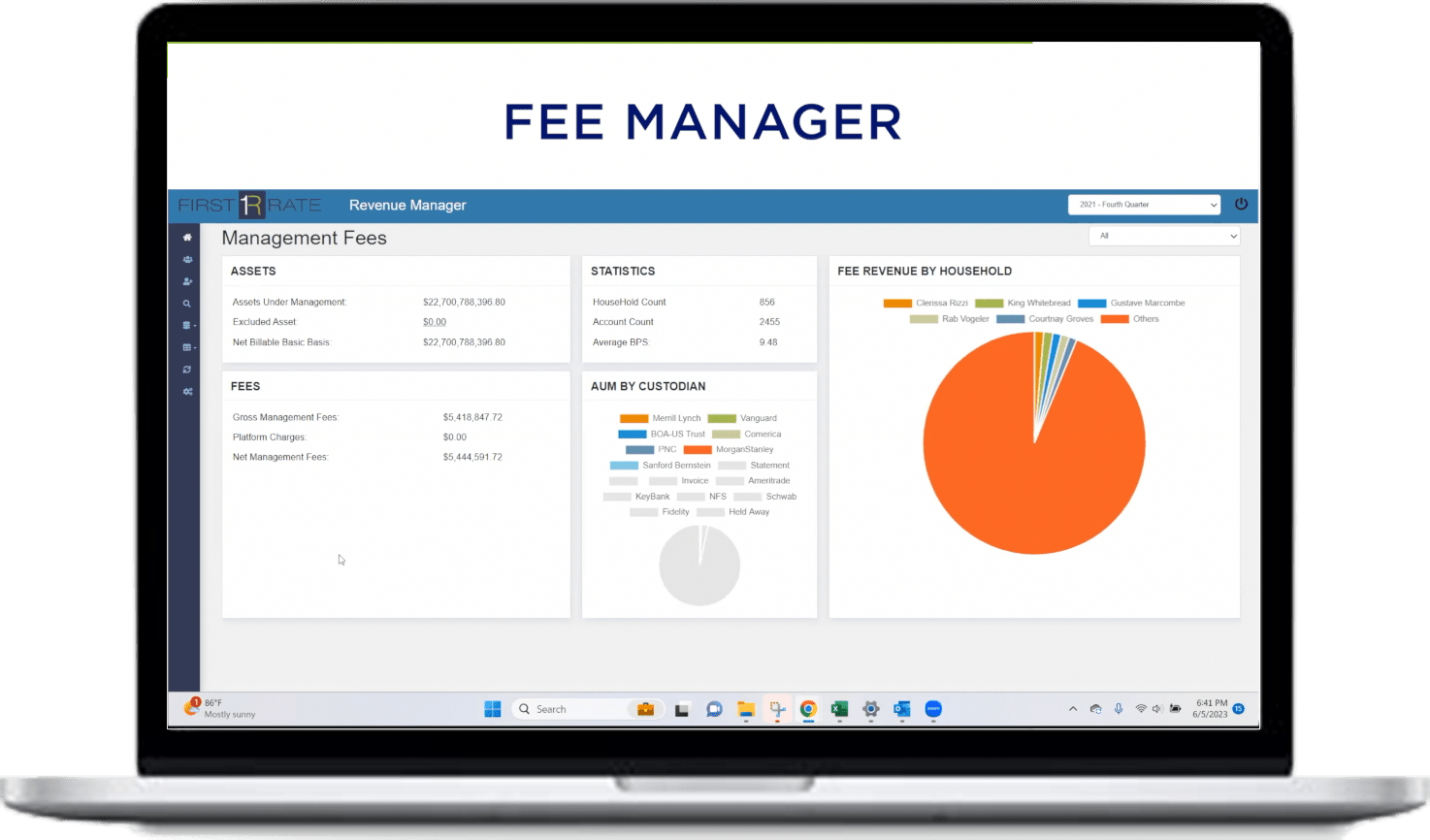

Fee Manager

Seamlessly move to an advisory model while providing critical business intelligence on revenue and risk.

Fee Manager is an automated, cloud-based fee billing system that provides analytics, advisor insights, security, accuracy, and reliability. It’s scalable and customizable, enabling multi-access user levels in both front-office and back-office views. As your firm grows and more competitors adopt advanced billing technologies, Fee Manager gives your firm the smarter billing advantage.